My ebook “Delay, Deny, Defend: Why Insurance Companies Don’t Pay Claims and What You Can Do About It” was once thrust into the highlight just lately, after UnitedHealthcare CEO Brian Thompson was once shot and killed in what government say was once a centered assault outdoor the corporate’s annual buyers convention. Investigators on the scene discovered bullet casings inscribed with the phrases “delay,” “deny” and “depose.”

The unsettling echo of the ebook’s name struck me and lots of others.

That killing – and the torrent of on-line outrage that adopted – put American citizens’ disappointment with well being insurers on the entrance of the nationwide dialog. Many of us replied now not by means of mourning Thompson, however by means of blaming UnitedHealthcare and different insurers for failing to pay for very important scientific therapies. Gleeful on-line trolls even celebrated the alleged killer as a heroic vigilante.

Talking as an insurance coverage student, I believe few must be stunned by means of this ghoulish response. The killing printed many American citizens’ resentment or even rage about insurance coverage corporations. And whilst the focal point has been on medical health insurance, those frustrations prolong around the broader insurance coverage panorama. House owners insurance coverage, as an example, is turning into tougher to get in lots of states at the same time as protection is shrinking, and auto insurance coverage charges are skyrocketing. Those developments are fueling common discontent with insurers of a wide variety.

Why policyholders really feel betrayed

And as I learn other people’s tales about their very own reports, I stored listening to echoes from my ebook. Too continuously, other people say, insurance coverage corporations lengthen paying some claims, deny different legitimate claims altogether, and drive policyholders to protect themselves in court docket – all to extend income by means of reducing declare prices.

However issues continuously start lengthy prior to somebody recordsdata a declare. Insurance coverage customers in most cases don’t know a lot about what they’re purchasing. For house owners, auto and lots of different varieties of insurance coverage, corporations seldom supply copies of coverage language or out there summaries of coverage phrases to potential policyholders.

Insurance coverage ads, like this one from the early Forties, continuously promote the promise of security and safety.

GraphicaArtis/Hulton Archive by the use of Getty Photographs

Even if customers have get entry to to insurance policies, many don’t learn or can’t perceive the lengthy, advanced prison paperwork. In a similar fashion, they may be able to’t watch for the numerous techniques a loss may just happen or the issues that would end result if it does. Consequently, they’re most effective conscious about a couple of key phrases and another way imagine that they’re going to be “in good hands” with a “good neighbor,” to cite two of the enduring words of insurance coverage promoting.

Then, when customers want protection, they uncover that there are important coverage gaps. Medical insurance can contain a tangle of boundaries because of supplier networks, scientific necessity laws and preauthorization necessities. House owners fairly be expecting that they’re going to be totally lined for all main losses, however insurers have reduce protection to account for emerging prices because of inflation and local weather alternate.

Consequently, when crisis moves, too many American citizens really feel like they haven’t gotten the protection they already paid for.

An insurance coverage trade American citizens can accept as true with

Rebuilding accept as true with in insurance coverage gained’t be simple, but it surely’s very important. Insurance coverage is the good protector of monetary safety for the American heart elegance, however most effective when it really works. As the new response demonstrates, it must paintings higher. The insurance coverage trade gained’t alternate on its own; the monetary pressures on insurers from expanding losses and fierce marketplace pageant are too nice.

To ensure that insurance coverage to serve its targets, lawmakers and regulators will want to take motion. In keeping with my analysis, I see 3 large spaces for development.

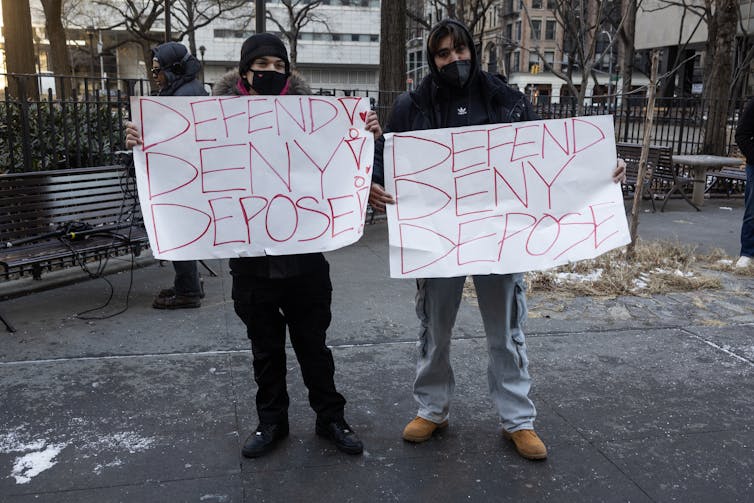

Protestors hang indicators outdoor Ny Legal Courtroom in New York on Dec. 23, 2024, after suspect Luigi Mangione gave the impression for his arraignment on state homicide fees within the killing of UnitedHealthcare CEO Brian Thompson.

Andrew Lichtenstein/Corbis by the use of Getty Photographs

First, the federal government can assist in making the marketplace for insurance coverage paintings higher. Markets want data, and higher data produces higher effects. Regulators must require that key details about protection be to be had in an out there structure for every type of insurance coverage.

Shoppers additionally want data at the high quality of businesses providing insurance policies, and whether or not an organization can pay claims promptly and moderately is a key measure of high quality. Shoppers don’t have get entry to to a lot dependable data on that now, so disclosure must be mandated there as neatly.

2nd, states could be smart to imagine minimal protection requirements, particularly for house owners insurance coverage, as insurers were reducing again on protection just lately to cut back prices. New York addressed a identical drawback in 1943, legislatively adopting a Usual Fireplace Coverage, since copied in lots of states.

Some 70 years later, the Inexpensive Care Act did one thing identical by means of requiring that insurers quilt 10 “Essential Health Benefits.” In each circumstances, lawmakers set minimal requirements that each and every corporate will have to meet. States once more want to imagine whether or not insurance plans is simply too vital to be left purely to the vagaries of the marketplace.

3rd, policyholders want efficient therapies when insurance coverage corporations are discovered to have acted unreasonably. Many insurance coverage claims lead to good-faith disputes about how a lot the insurance coverage corporate must pay — as an example, whether or not roof injury was once led to by means of hail, which is normally lined by means of insurance coverage, or simply put on and tear, which isn’t. However different occasions, insurance coverage corporations deny claims after insufficient investigations or for spurious causes.

For instance, a 2023 Washington Submit investigation concluded that within the wake of Typhoon Ian, some Florida insurance coverage corporations aggressively sought to restrict payouts by means of changing the paintings in their adjusters who inspected broken houses. Some policyholders and their households had their Typhoon Ian claims decreased by means of 45% to 97%. The American Policyholder Affiliation, a nonprofit insurance coverage trade watchdog team, claimed to seek out “compelling evidence of what appears to be multiple instances of systematic criminal fraud perpetrated to cheat policyholders out of fair insurance claims.”

A mobile phone photograph presentations the broken house of retired couple Terry and Mary Sebastian, whose tale was once featured in a 2023 Washington Submit investigation.

Thomas Simonetti/Washington Submit by the use of Getty Photographs

When other people in finding themselves in this type of scenario, they have got to spend loads of effort and time combating to get what they have been owed within the first position. Even if an insurance coverage corporate in the end relents, it nonetheless hasn’t fulfilled its authentic promise to the policyholder to settle claims promptly and moderately. In those circumstances, requiring further reimbursement to policyholders and insurer disincentives for unreasonable habits would degree the enjoying box.

The deep resentment many American citizens really feel towards insurance coverage corporations become obvious after the killing of Brian Thompson. Reforms similar to those could be a significant reaction to that resentment.